I get this question all the time.

In the past there was not much difference. The phrases could be used, and still are used, somewhat interchangeably.

Check out my website, Longleaf Lending, for example. I use both phrases throughout, well, because of SEO. Hard money actually seems to generate more searches, so we focus on that.

In the last several years, there does seem to be a growing distinction between the two.

Here’s what is going on.

What is a hard money loan (or a private money loan)?

So first, if you’re unfamiliar with a hard money loan, here’s a an overview:

These are bridge loans made by non-bank lenders to real estate investors

Investors use the loan to quickly purchase a property (usually with ~90% hard money) and then execute a rehab (often times funded 100% by the hard money lender) to create value in the asset

Secured by collateral (real estate property), usually in first lien, but can sometimes also be 2nd lien

High interest rate, short duration loans: most are 10%+ interest only and 6-12 months in length

Often unregulated (except in certain states such as California)

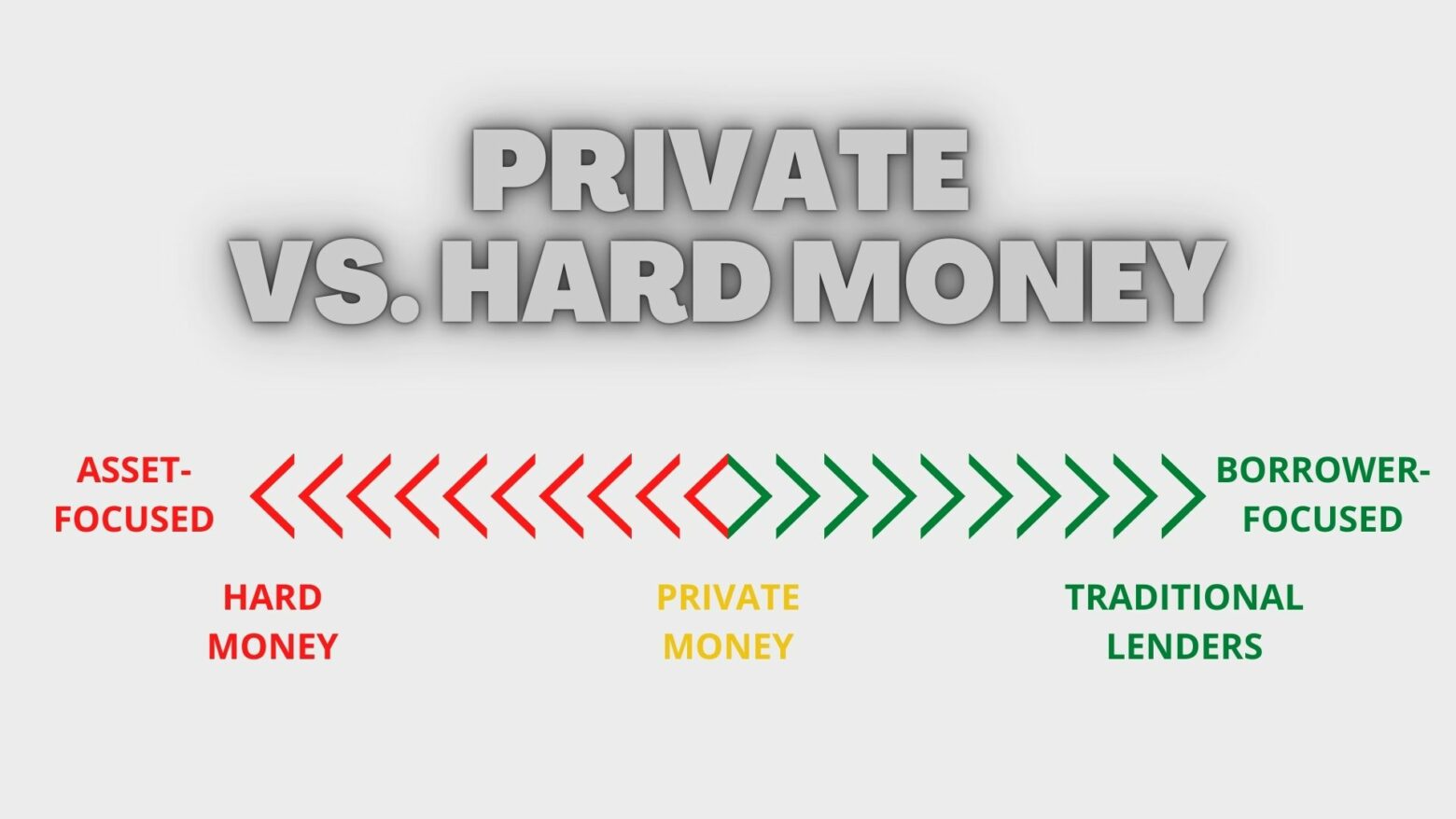

Lenders that makes these loans are known as asset-based lenders – they focus first on strong loan-to-values and the cash flow potential of an asset, and then on the borrower’s credit, experience, etc.

Exit strategies are either for the investor to flip (sell) the property quickly, or they will refinance into a long-term loan to hold for cash flow and appreciation (through short-term or long-term rentals)

These loans are high interest rate loans because they are riskier – the lender is usually prepared to take back the property and recover the capital if it goes south. This can be messy if a project is abandoned by a borrower half-way through. It takes resources to manage

A growing distinction between private and hard money

In the past, smaller local lenders used to pride themselves as being private money lenders and not hard money lenders. For better or worse, that phrase is being hijacked by the big players in the industry. I recently attended several industry conferences, and it’s clear they want to do away with the term Hard Money.

I get it – the phrase does seem to have negative, predatory overtones. It’s really not my favorite term. I prefer private lending or private money. For the industry, I think it has a lot to do with lobbying and promoting the maturity or professionalism of the growing industry.

Changing underwriting requirements – more focus on the borrower

This shift is also coinciding with a growing shift to underwriting requirements. No longer are private lenders strictly asset-focused. They are taking a more wholistic approach to qualifying the loan.

Credit score and borrower experience are now key considerations for clearing approval for one of these loans, especially with large nation-wide lenders. It will also have a lot to do with the rate that you may qualify for. These are the primary pricing grid considerations private lenders might use:

Product type

Loan to value

Credit score

Borrower experience

Then, usually several adders such as DSCR coverage (if long-term), geographic region, cash-out, etc.

Expanded product offerings

Private lenders also offer more products – hard money no longer refers to just a short-term hard money bridge. For example, we now offer a long-term rental loan, ground-up new builds, and multi-family.

Some lenders that have historically focused on the single family residential asset class are now even lending on smaller mixed-use properties.

Maturing secondary market is accelerating the shift

Large amounts of Wall Street capital has been chasing yield for years. One place they’ve found it? Loans from private lenders.

Well how do they get the yield from these notes? Enter the large aggregators or secondary note buyers. They buy notes from the originators that are in the trenches making the deals happen (like my company Longleaf). Next up, the notes get securitized and packaged up into $25, $50, or $100 million chunks. This is what Wall Street buys.

It’s similar to how the mortgage secondary market functions, now, happening in the mysterious world of private lending.

Trickle down affect from this? Wall Street gets to call the shots and dictate credit or underwriting terms. So if you want to grow through note sales (and many lenders have grown quite large doing so), you need to comply.

Lenders that participate in note sales find several advantages in this growth strategy:

- “Unlimited” capital to tap into

- More efficient than raising a fund

- Faster acceleration of company resource growth with the capital backstop

- De-risks some of the business vs. holding the notes on the balance sheet